The CNS North Korea Missile Test Database

A collection of missile tests including the date, time, missile name, launch agency, facility name, and test outcome.

Statement of Ernest J. Moniz

CEO of the Energy Futures Initiative and of the Nuclear Threat Initiative

Former United States Secretary of Energy

Before the

House Foreign Affairs Subcommittee on Europe, Energy, the Environment and Cyber

Hearing on

Russia’s Waning Global Influence

Chairman Keating, Ranking Member Fitzpatrick, members of the subcommittee, thank you for the opportunity to testify today on the nuclear security and energy policy implications of Russia’s unprovoked and brutal war in Ukraine.

I currently serve as CEO of the Energy Futures Initiative (EFI) and of the Nuclear Threat Initiative (NTI). EFI is a nonprofit organization dedicated to harnessing the power of technology and policy innovation to accelerate the clean energy transition. NTI is a nonprofit global security organization focused on reducing nuclear and biological threats imperiling humanity. From 2013- 2017 I served as the Secretary of Energy during President Obama’s second term.

Russia’s unjustified ongoing war on Ukraine is a clear violation of international law and of Russia’s previous commitments, including the security assurances it provided to Ukraine in the Budapest Memorandum. This brutal war has taken a horrific toll on the Ukrainian people, resulted in significant Russian casualties and enduring economic dislocation, and upended the global community and economy.

Beyond measure, the first victims are the Ukrainian people. They have suffered tremendous losses, been subjected to unspeakable war crimes, and the physical infrastructure in many regions of Ukraine has been severely damaged or destroyed. Ukraine’s recovery will take decades and trillions of dollars when the fighting finally ends.

Russia is likely to be the second biggest loser from its war of choice–-a deeply miscalculated self-inflicted wound. Economically, Russia has lost its best energy customers in Europe. Once Europe adapts to other sources of supply and invests in new energy infrastructure, for instance, to support the import of liquid natural gas from other countries including the United States, and accelerates the low-carbon transition, Russia will need to rebuild its energy enterprise without its historically largest and nearby market – at the same time trying to overcome the distrust and

animosity of many others. In particular, new markets for the Russian natural gas no longer going to Europe will require major investments in new infrastructure.

Militarily, Russia has performed surprisingly poorly, and its shortcomings in planning and execution have been on full display for the world to see. Many Russian troops have been unprofessional, ill-trained, ill-supplied and demoralized. Much of its equipment is old and in disrepair. Russia does possess and has demonstrated some modern, sophisticated highly accurate long-range conventional strike capacity, but it appears to have insufficient stocks of such weapons to wage a long war of attrition, which this conflict has become.

Geopolitically, Russia’s reputation and influence are badly damaged. It has a shrinking set of friends and partners and is increasingly dependent on China, which is maintaining some distance from Russia’s misadventure in Ukraine. Russia is increasingly isolated in the international community. In the October 12, 2022, vote on the UN General Assembly resolution condemning Russia’s attempted annexation of Ukrainian territory, only Belarus, DPRK, Nicaragua and Syria voted with Russia against the resolution. China, India and 33 other countries abstained, while a very significant 143 countries voted for the resolution. There is no prospect of having these Ukrainian territories internationally recognized as a legitimate part of Russia. The invasion has likely cemented Kyiv’s position as the legitimate government of all of Ukraine, including Crimea, in all international institutions of consequence, starting with the United Nations.

That said, Russia retains a huge nuclear weapons arsenal, including approximately 2000 nuclear warheads for non-strategic systems. To put this in context, the United States and Russia have, by far, the world’s two largest nuclear weapons arsenals. Our total nuclear weapons stockpiles are roughly comparable, though they are configured differently, and Russia has slightly greater numbers. Both countries are in compliance with the New START treaty limit of 1550 warheads on deployed strategic delivery vehicles. Beyond that, as noted, Russia is believed to have approximately 2000 so-called “tactical” nuclear weapons. The United States also has several thousand non-deployed nuclear warheads, but only a fraction of those is associated with non-strategic aircraft based in Europe.

For fifty years the United States and the Soviet Union/Russia have negotiated a series of nuclear arms control agreements to mutually limit and then reduce their nuclear arsenals. Since the end of the Cold War the size of our respective arsenals has been reduced dramatically. A concern now, however, is that the abysmal performance of Russia’s conventional military in Ukraine will cause Russia to feel it needs to maintain and perhaps even increase its reliance on nuclear weapons for its security and military objectives, and possibly for internal political purposes as well. This would run contrary to the stated U.S. policy goal of seeking to reduce reliance on nuclear weapons globally, as put forward in the recent U.S. Nuclear Posture Review.

Importantly, Russia has expressed an interest in discussing a successor agreement to replace New START when it expires in February 2026, as has President Biden. This is in our mutual interest. At the same time, Russia has to date resisted efforts to include non-strategic nuclear warheads in future arms control agreements. All types of nuclear weapons – strategic, non-strategic, non-deployed – should be on the agenda when strategic stability talks resume. Dialogue between the world’s largest nuclear powers to reduce nuclear risks is essential even when there is so much that divides us. Members of Congress should be supportive of bilateral US-Russian dialogue on topics of existential mutual interest – particularly to prevent nuclear war and a nuclear arms race.

With the conflict in Ukraine, the risk of escalation or blunder leading to an even wider war in Europe is real. President Putin’s repeated implicit threat of nuclear weapons use to deter outside interference with his invasion of Ukraine is very dangerous and increases the risks of catastrophic mistakes.

This nuclear saber-rattling broke one taboo and threatens another even more grievous one. The first taboo is that of a nuclear weapon state (Russia) threatening a non-nuclear weapon state that is in compliance with its nonproliferation commitments (Ukraine) with the use of nuclear weapons. This violates not only the assurances Russia provided to Ukraine in the Budapest Memorandum of 1994, but more generally the negative security assurance that Russia (along with each of the recognized nuclear weapons states) has given to nonnuclear weapon states in the context of the Nuclear Nonproliferation Treaty. Violating this taboo damages the NPT regime and efforts must be taken to restore the sanctity and credibility of this negative security assurance for states that forego having their own nuclear weapons capabilities.

The second taboo which is essential to uphold and strengthen is the taboo against nuclear use. This taboo has held for over 77 years, and it must not be broken now. Any use of a nuclear weapon in this conflict – including a tactical or low-yield nuclear weapon – would be unjustified and catastrophic for Ukraine and indeed the world. Where it could lead in terms of escalation is unpredictable and highly dangerous. The international community has made it clear to President Putin that nuclear use in Ukraine is unacceptable, would provoke a very strong response from the United States and NATO, and would be condemned globally. This message has come not only from the United States and countries in Europe, but most significantly from President Xi and from other important friends of Russia. President Putin has recently made statements, including at the Valdai Club in late October, indicating that he sees no political or military basis for using nuclear weapons in Ukraine. The recent statements from President Putin and from President Xi are reassuring developments, but this is no time for complacency. The international community must remain vigilant and alert to the risks as the war grinds on and must continue to make clear to President Putin privately and publicly that this is a line he must not cross, and that doing so would bring extremely severe consequences for him and his country.

Diplomacy is the only sensible path to settling the conflict in Ukraine and rebuilding an effective security architecture for Europe and indeed the world. The security challenges coming out of this crisis are immense. First there is the need to establish a new “nuclear order.” The current order has been disrupted not only by the way in which Putin has used nuclear coercion in this conflict, but also by the way in which he has weaponized civilian nuclear power plants and risked the safety and security of civil nuclear power to advance his war aims and terrorize the Ukrainian people. I will say more on this shortly.

Second, the Euro-Atlantic security architecture that had been eroding over the past decade or more has completely collapsed and it will take years if not decades to rebuild a new, more enduring architecture for the future. Trust has been deeply eroded, and the agreements that had long limited conventional and nuclear arms in the Euro-Atlantic region and provided transparency and confidence-building measures have for the most part collapsed. Though it seems unimaginable now, the United States and Europe will have to figure out how to include Russia in a future Euro-Atlantic security architecture that provides sufficient security for all nations, including Ukraine and Russia, such that the incentives for future conflict are reduced.

Third, the United States will have to manage the evolution of its nuclear relationship not only with Russia, but with China too. China currently has a much smaller nuclear stockpile than either the United States or Russia, but it is on the verge of a significant expansion. It is only a matter of time – a decade or two — before it could become a near peer competitor when it comes to nuclear weapons. There is concern about a new bipolar construct with the United States on one side and China perhaps joined with Russia on the other. But even if that is not the outcome, the United States needs to figure out how to simultaneously maintain mutual verifiable limits on U.S. and Russian nuclear arsenals while also beginning to seek greater transparency into and eventually limits on China’s growing nuclear arsenal. Three comparably large nuclear weapons stockpiles pose qualitatively new challenges for arms control. In Europe and Asia, the risk of conflict escalating to nuclear use must be managed, as well as the potential for a significant nuclear arms race in either or both regions. Related, the United States must prioritize its alliance relationships to reassure our allies and keep the barriers to future proliferation strong and high.

Nuclear stability ultimately would be served best by significant progress towards nuclear weapons elimination globally, but getting from here to there has been made even more complicated than it already was by the current and coming nuclear developments noted above.

The Russian invasion of Ukraine also raises energy security concerns to a global level not seen before. The responses of the United States and its allies and partners are critical for maintaining global stability and security in the months and years ahead. From an energy perspective, thoughtful policies and actions could also help establish clearer pathways for deep decarbonization while meeting critical energy security objectives.

I would like to start with some history that is relevant to the topic of energy security. In 2014, Russia invaded Ukraine and then illegally annexed Crimea. In response, later that year, the G-7 (formerly the G-8 until Russia was removed in response to its invasion of Ukraine) and EU met in Rome at the energy minister level and then in Brussels at the leader level and adopted a set of “modernized” energy security principles, reflecting the many changes in the definition of and needs for energy security from its original narrow focus on oil supply disruptions after the Arab Oil Embargo of the 1970s.

Excerpted text from the Brussels declaration offers some valuable guidance about a collective responsibility for energy security and how we should view and respond to Russia’s most recent full-scale invasion of Ukraine:

“The use of energy supplies as a means of political coercion or as a threat to security is unacceptable. The crisis in Ukraine makes plain that energy security must be at the center of our collective agenda and requires a step change to our approach to diversifying energy supplies and modernizing our energy infrastructure…Under the Rome G7 Energy Initiative, we will identify and implement concrete domestic policies by each of our governments separately and together, to build a more competitive, diversified, resilient and low-carbon energy system. This work will be based on the core principles agreed by our Ministers of Energy … in Rome:

Based on these principles we will take the following immediate actions:

Since these principles were adopted in 2014, two other issues that have become more prominent should be added to this list of seven principles. These are:

These principles are extremely relevant today as the world grapples with the energy disruptions associated with Russia’s invasion of Ukraine. How the community of responsible nations treats Russia, its energy exports, and its role in international organizations and forums are key issues that deserve a sustained and strategic focus in the days ahead. I will discuss these principles further and how they can and should inform future actions of the United States and its allies and trading partners going forward, including actions on deep decarbonization and for the transition to clean energy.

The value of energy decarbonization for enhanced energy security deserves emphasis. The EU has been a leader in committing to net-zero greenhouse gas emissions by 2050. However, it has been less convincing in developing an implementable roadmap for the associated energy transition, specifically including the role of oil and natural gas over the next decades. Consequently, the net-zero goal rises in importance but must be addressed within the reality of continued reliance on fossil fuels in the meantime. Climate change and energy security and geopolitics must be understood and addressed as one conversation.

Some data are also important for understanding what the role of Russia was in European energy supplies prior to its 2022 invasion of Ukraine. These data are not only important for assessing whether Russia’s influence is waning, but also to inform some key strategies that could help ensure that Russia remains isolated for its repeated violations of international law.

Importantly, according to the International Energy Agency (IEA), in the third quarter of 2022, exports of Russian gas to the EU via pipeline decreased by 70% compared to the same period in 2021. At 10 billion cubic meters (bcm), Russia’s pipeline exports to Europe are at the lowest level in the last two decades. Russia is clearly using its energy as a weapon and the United States and others have responded accordingly.

Russia’s weaponization of its energy supplies has come at a price to Europe and the world. According to the International Energy Agency (IEA), natural gas prices on Europe’s TTF – an LNG pricing location in the Netherlands that frequently serves as the proxy price for all of Europe’s LNG – were eight times higher in the third quarter of 2022 than the five-year average. There have been pipeline bottlenecks, and reports of LNG tankers in European ports, waiting in the offtake queue. While other factors are also in play, the Russian invasion of Ukraine has resulted in the need for a major reorganization of European natural gas markets and infrastructure in a short time. This has been very disruptive for Europe, but also well beyond its borders.

Countries have responded to these Russian actions. From the U.S. perspective, in the first four months of 2022, 74% of US LNG exports went to Europe compared to an average of 34% in 2021. Between March and October of 2021, U.S. LNG exports to Europe totaled 12.8 million tons (about 18 bcm); over the same time period in 2022, U.S. exports to Europe totaled 30.8 million tons. IEA notes that “LNG supplies from the United States to the European Union stood at 12 bcm in Q3 [2022], surpassing Russia’s piped exports for the first time in history.”

Other countries and gas suppliers are also responding to Russia’s weaponization of its gas supplies. Norway and the U.K. have increased their natural gas production, pipeline exports from Azerbaijan via the Trans Adriatic Pipeline have increased by 50% in the first three quarters of 2022 over the same period last year, and all of OECD natural gas production is expected to rise by five percent at the end of 2022. In September 2022, Spain, which imports no Russian gas, boosted the capacity of an existing pipeline to France by 18%.

Europe is also expanding its LNG import infrastructure. The European Council of the European Union has indicated that, post-Russian invasion, there are 17 planned LNG import facilities in the EU with startup dates ranging from 2023 to 2026 and three facilities under construction in Greece, Cyprus, and Finland. Germany is building an LNG import terminal on the German North Sea and has chartered four floating storage and regasification units (FSRUs) to rapidly add LNG regasification capacity. In short, many countries have mobilized to help Europe meet its near-term natural gas needs going into the winter of 2022-23 in the face of Russia dramatically reducing its exports to Europe.

It should be noted, however, that while Russia has disrupted its natural gas pipeline exports to Europe, its LNG exports to Europe have increased. Russia has four LNG export terminals and its LNG exports to Europe were 41% higher in August of 2022 than the same time last year.

Absent a very cold winter, Europe has adequate gas supplies to get through the next several months. The IEA is, however, warning of a possible shortfall in Europe next summer as demand for LNG grows in Asia, creating increased competition for supplies.

This underscores another possible scenario on which the United States and its allies should focus: increased Russian LNG exports to Asian markets could replace Russia’s expected revenue losses as Europe continues to reduce its reliance on Russian energy supplies. This could result not in the waning of Russian influence as an energy supplier but simply in a shift to Asia of Russian energy supplies and associated influence. Many things will have to fall in place for Russia to take advantage of this option, giving the United States and its allies a window of opportunity to deflect it.

There are concerns about Russian oil and refined product exports as well, although oil is a much more fungible commodity than natural gas as it is more easily transported and, when necessary, redirected. Oil prices, however, rapidly respond to perturbations in the market, including large ones like the Russian invasion of Ukraine, and the COVID pandemic during which demand and therefore prices fell. Oil price uncertainty and volatility will likely persist given great demand unpredictability in 2023: reopening of China’s economy may materially increase global demand, while a global recession would do the opposite. These factors overlay the impact of Europe’s coming ban on seaborne Russian exports of crude oil and refined products.

The EU will ban Russian seaborne oil imports starting December 5 and refined products on February 5. By the end of September, Europe had decreased Russian seaborne crude oil imports by about seven hundred thousand barrels per day. The reduction to zero by December 5 must be nearly twice that size and accomplished in a much shorter time than the first seven months of war. Nevertheless, the expectation is that the global crude oil market will adjust reasonably quickly. Europe has already upped its imports of crude oil from the U.S. and others.

However, there are secondary considerations that may make readjustment more difficult for refined products, especially diesel fuel. The displacement of Russian crude by U.S. crude entails refining lighter oil, with a decrease in distillate production. The EU has already been more dependent on Russia for diesel: almost 30% of Europe’s oil product imports are from Russia and much less progress has been made in reducing such imports than has happened for crude oil. The February 5 date provides some extra time, but the challenge is greater.

This is how IEA’s recently released 2022 World Energy Outlook describes the current global energy situation: “Today’s energy crisis is delivering a shock of unprecedented breadth and complexity. The biggest tremors have been felt in the markets for natural gas, coal, and electricity – with significant turmoil in oil markets as well, necessitating two oil stock releases of unparalleled scale by IEA member countries to avoid even more severe disruptions. With unrelenting geopolitical and economic concerns, energy markets remain extremely vulnerable, and the crisis is a reminder of the fragility and unsustainability of the current global energy system.” The United States is one of those member countries that has released oil stocks from its Strategic Petroleum Reserve, adding important volumes of oil to global oil supplies in response to the Ukraine crisis.

Clearly, Russia has caused an energy security crisis of global proportions — and the world has responded. The EU has already banned Russian coal and plans to end Russian oil imports by the end of this year. The U.S. has banned imports of both Russian oil and natural gas. As the world’s largest economy, the United States has also used a number of financial instruments in reaction to Russia’s war of choice. These include sanctions via executive order on a range of targets, including on individuals in Putin’s inner circle; on a number of its defense companies; on the financing of some of Russia’s largest banks and energy companies; and on individuals determined to be responsible for malicious cyber-attacks that could pose a threat to national security.

The U.S. has also imposed a SWIFT ban limiting the ability of Russian banks and credit institutions to trade currencies and goods and suspended a range of credit finance options for projects in Russia and exports to Russia. According to the State Department, these and other U.S. sanctions have been imposed in “close coordination with the EU and international partners.” Going forward, it is important that these financial instruments be used in a strategic manner, with a strong focus on sustaining American leadership in the global financial system.

Worldwide reliance on oil, natural gas, and coal – and Russia’s willingness to weaponize its exports of these energy supplies – has demonstrated the significant national, regional, and global vulnerabilities created by this dependence. As noted, Russia’s actions raise many issues that are highlighted in the G-7 modernized energy security principles outlined earlier. The policy responses of the United States and its European allies and trading partners will likely establish a path forward to address both conventional energy security and the energy security implications of climate change that will reduce demand for Russia’s oil and gas, clearly an unintended consequence for Russia’s of its weaponization of its energy resources.

A stark outcome of the Russian invasion of Ukraine has been to highlight, in a significant way, the critical near- to mid-term need for natural gas. This need can be met, in part, by “developing flexible, transparent, and competitive energy markets, including gas markets,” and by “diversifying of energy fuels, sources and routes, and encouragement of indigenous sources of energy supply,” two of the G-7’s modernized energy security principles.

The fact that the United States has been able to dramatically increase exports of LNG to Europe while maintaining exports to other trading partners illustrates the importance of these principles. This critical role of the United States has been enabled by dramatic increases in U.S. domestic natural gas production. Between 2001 and 2020. U.S. natural gas production increased by 76%, the United States is now the number one exporter of LNG in the world and has, by virtue of its lack of destination clauses in its contracts, advanced global gas market liquidity through destination flexibility for its LNG cargoes. Just this year, FERC-approved LNG export terminals under construction went from 3.6 bcfd in February to 11.9 bcfd in late October, a 231% increase in just seven months.

This increase will be critical in the current global situation. It is expected that by 2024, 19 new LNG regasification terminals will start operation. India is building out a natural gas pipeline infrastructure and by 2024 is expected to double the capacity of its LNG import terminals. Clearly, it is not in the interest of the United States and other countries for the natural gas demand associated with these expansions to be met by a country that has shown a complete disregard for international law and stability. Construction of U.S. LNG export facilities will help meet this demand and reduce opportunities for Russian exports.

Also, the United States and its allies should seek to address these growing needs for natural gas supply via diplomatic activity. Policies and geostrategic strategies should be developed and implemented to retain and expand U.S. LNG exports to these and other key Asian countries, in addition to those to Japan and S. Korea, the two largest recipients of US LNG in 2021. Australia could also play a key role here. A collective diplomatic response of the United States, its allies and trading partners in the range of diplomatic forums is essential, as are bilateral approaches to key countries.

In this regard, it is also important to understand that to increase LNG exports to meet the needs of U.S. allies and trading partners, the U.S. needs to increase domestic production sufficient to meet domestic demand and the current and future demand for LNG. This, however, raises climate change/environmental concerns.

U.S. natural gas is the source of over 20% of its energy-related carbon emissions. The carbon intensity of upstream natural gas production, processing, and transport is responsible for half of total emissions in the LNG supply chain: liquefaction is 33%, shipping is 16% and regasification is one percent. Everything that can be done to reduce greenhouse gas emissions across this supply chain, including capturing methane emissions, should be done to support both near- to mid-term energy security and climate change concerns.

Beyond this immediate threat to energy security, however, is the acceleration of climate change, the impacts of which are increasingly visible. The recent heatwave in Pakistan drove temperatures to 122 degrees in May followed by flooding that left a third of the country under water. Glaciers across the globe are melting, threatening hydropower supplies in the Western United States, the Himalayas, and South America. Wildfires have devastated regions of Spain and Portugal and closer to home, New Mexico has recently had the largest wildfires in its history. Navigating the Mississippi – a critical avenue for US commerce – has become difficult as parts of the river are drying up. This is also true of rivers in Europe, where river cruise passengers on the Rhine have had to be bussed across sections of the river that are too dry to navigate.

In the near term, there are actions that could reduce energy demand and address climate change issues. The energy security principle – “Enhancing energy efficiency in demand and supply, and demand response management,” is reinforced by an IEA analysis released shortly after the Russian invasion of Ukraine of how Europe could meet its near-term energy needs absent supplies from Russia. This ten-point strategy included recommendations to:

This crisis has also illustrated another critical issue: the essential need for thoughtful, sequenced policies that lead to deep decarbonization by mid-century while ensuring that critical energy security needs previously met by oil and natural gas can be met. Again, the G-7 energy security principles offer guidance in this regard:

EFI analysis has identified a set of breakthrough technologies that are essential for deep decarbonization by mid-century. These include long duration storage, including battery technologies; advanced nuclear generation, including both fission and fusion; advanced manufacturing technologies; smart cities; clean fuels including hydrogen and its various colors (blue, green, turquoise, pink); and deep decarbonization/large scale carbon management including carbon capture and storage, sunlight to fuels, enhanced biological and ocean sequestration and direct air capture.

Investments in clean energy innovation are essential as are investments in the infrastructure needed to deploy these technologies at scale. The new Inflation Reduction Act and the Infrastructure Investment and Job Act laws go a long way towards addressing these two critical energy security principles.

At the same time, transitioning the U.S. and global energy systems is a very time-consuming process. Key energy technologies, e.g., affordable wind and solar generation, have taken decades to develop and deploy. Also, transforming energy systems is an inherently slow process. Energy is a highly capitalized commodity business with complex and extensive supply chains, established customer bases, providing essential services at all levels of society. This creates considerable inertia in energy systems at a time when rapidly transitioning to clean energy systems is needed. Actions to address this need for acceleration are essential.

This takes me back to the role of natural gas for which there is an ongoing need. Technologies do not currently exist for many industrial processes where natural gas consumption is essential. The intermittency of wind and solar and the lack of long duration storage options points to the ongoing need for a fuel to provide backup and load following power generation. Again, that fuel is currently natural gas. It could be hydrogen in the future but developing affordable and clean hydrogen production and deploying the production, transmission, storage, and sequestration infrastructures needed for this transition will be a very time-consuming process.

Natural gas is a critical fuel for lowering emissions from coal generation, on which many nations in the world heavily rely. The majority of U.S. economy-wide CO2 emissions reductions over the last decade has come from coal to natural gas switching in the electricity generation sector. China has made more modest reductions in the same way, whereas the Russia-Ukraine war has caused Germany to go temporarily in the opposite direction. Clearly, natural gas will continue to play a critical role in the multi-decadal transition to clean energy systems.

Russia’s role as a major global fuel cycle player will likely be affected by its invasion of Ukraine. The world is witnessing the first-ever full-scale war in a country with a significant nuclear power infrastructure. Since March of this year, the Russian government has recklessly attacked and occupied Ukraine’s Zaporizhzhia and Chernobyl nuclear facilities. Russian forces have abused staff at both sites and shelled around these facilities to the point of offsite power loss. Russia’s decision to risk large-scale radiological contamination and jeopardize the health of the people and the environment around these civilian nuclear reactors is a new and disturbing type of brinksmanship. It should be noted that the Zaporizhzhia nuclear power plant, the largest in Europe, is located literally at the front lines of the war. Thus far, the international community has been lucky there has not been a major radiological release. The world owes a debt of gratitude to the Ukrainian nuclear operators putting their lives on the line to prevent a catastrophe.

This is a pivotal moment for the future of nuclear power, which can play an important role in helping the world meet its climate goals and increase energy security. If the role of nuclear energy in electricity generation is going to increase over the coming decades, long-term investment, planning, and political support are needed now. History has shown that major nuclear accidents like the meltdowns at the Fukushima Daiichi nuclear plant significantly damage the prospects for nuclear power to grow. A radiological release in Ukraine would have significant repercussions around the globe and disrupt, if not end, near-term progress on expanding nuclear power as a tool for battling climate change.

Strengthening Nuclear Plant Resilience During Crises

While we cannot predict all the implications of the war, one conclusion is already clear: if reliance on nuclear power is to expand, governments, regulators, and nuclear operators will need to adapt to a new threat environment. For decades, international efforts to protect nuclear facilities have been grounded in the assumption that the greatest threat was from non-state actors. Russia’s attack on Ukrainian nuclear facilities and other state-level attacks on nuclear facilities in recent years demonstrate that this assumption needs to be reevaluated.

While the Zaporizhzhia nuclear power plant safety systems have performed as designed, thereby warding off any major safety incidents despite having external power interrupted multiple times, the international community can reduce the risk of attacks on nuclear facilities by strengthening norms and laws around protecting nuclear facilities in times of armed conflict. One model could be India and Pakistan’s 1988 agreement that prohibits “any action aimed at causing the destruction of, or damage to, any nuclear installation or facility in the other country.” The United States should take the lead on this issue by making a similar pledge not to attack other countries’ civilian nuclear facilities and encouraging other countries to do the same. Another point of emphasis could be to establish a common consensus that an attack on a civil nuclear facility is in no one’s interest and does not achieve any meaningful military goal.

Moreover, there should be a greater focus on proactively helping countries improve the resilience of their nuclear facilities during prolonged crises. Resilience-building measures could include requiring operators to have contingency supplies such as extra generators or more rigorous training exercises focused on sustaining security under adverse conditions. Such measures are not important just to prepare for times of war, but also for other political, economic, or natural disruptions that could occur in the future. The United States should support countries’ efforts to strengthen the resilience of their nuclear facilities against long-term crises that can interfere with normal operations.

Protecting nuclear facilities during a war is likely beyond the capability of any individual state and requires an international response. Since Russia’s invasion of Ukraine in February of this year, the International Atomic Energy Agency (IAEA) has been on the front lines of reducing nuclear risks in Ukraine. The role it is playing is both unprecedented and essential. At this very moment, four IAEA experts are in harm’s way, deployed within the Zaporizhzhia plant.

The IAEA is functioning as the “arbiter of truth” for safety and security conditions in Ukraine by providing regular updates to the public about conditions at the plants. These are essential in helping stakeholders around the world understand what is happening in Ukraine and reminding us of the ongoing crisis.

The IAEA is also playing an important role by advocating for the safety and security of nuclear facilities within Ukraine, by sending experts and equipment, and through Director General Grossi’s personal leadership. Director General Grossi has repeatedly and publicly voiced concern about the safety and security of nuclear facilities in Ukraine. He has also requested that specific measures be taken to reduce risk, like enacting a nuclear safety and security protection zone around the Zaporizhzhia nuclear power plant. He defines the protection zone simply: no one shoots into the plant, and no one shoots out from the plant.

This will likely not be the last war in a country with a large nuclear infrastructure, especially if nuclear power significantly expands. The IAEA is setting an important and positive new precedent for how it engages with international crises. The United States should support efforts to make these changes sustainable.

Russia’s Role in the Nuclear Market

Russia’s state nuclear energy corporation, Rosatom, which has provided staff to support the occupation of Ukraine’s Zaporizhzhia nuclear power plant, has likely forever tarnished its reputation. Despite the recklessness Russia has demonstrated, any significant changes in the international nuclear market will take time given the long duration of nuclear fuel contracts, Russia’s role in maintaining equipment of the reactors it has built, and the time it will take to develop new fuel sources.

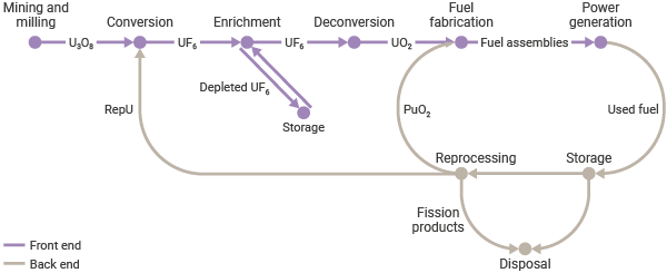

Looking across the major elements of the nuclear fuel cycle, Russia is a significant player in mining and milling, accounting for 14% of U.S. raw uranium supply, while playing a strong role in uranium conversion and enrichment, and as a provider of commercial nuclear power generation services.

Conversion and Enrichment: Russia is one of five countries with uranium conversion facilities. In 2020 Russia accounted for nearly 40 percent of global conversion services. Current capacity is well more than current production, and so any significant removal of Russian uranium conversion capacity from access to global markets could be largely offset by increased production in the other four countries, including the United States.

The global uranium enrichment industry consists of four major entities: state-owned enterprises in Russia, China, France and URENCO (a Dutch-British-German consortium); URENCO operates an enrichment facility in New Mexico, using European-origin centrifuge technology. In 2020, Russia accounted for nearly half of global uranium enrichment. Russia’s enrichment capacity is more than double that of its nearest competitor. Russian enriched uranium provides about 28 percent of U.S. market demand and is capped under an existing government-to-government agreement known as the Russian Suspension Agreement.

Reactor Sales: Globally, plans for deployment of new nuclear generation are proceeding rapidly, and Russia currently plays a prominent role. The International Energy Agency projects the potential need for 30 gigawatts per year of new nuclear power generation capacity in the 2030’s to meet mid-century climate targets. For comparison, each of the two new nuclear reactors being constructed at the Vogtle plant site in Georgia are approximately one gigawatt in scale. Next-generation small modular reactors are often only a fraction of that capacity.

Russia and China are currently engaged in large programs to build new nuclear power generation as part of their domestic energy programs. They are seeking to leverage their respective domestic nuclear industrial base to offer nuclear generation services on the global market, on a turnkey basis, and backed by concessionary government-backed financing. The International Atomic Energy Agency reports that as of December 31, 2021, there were a total of 52 new nuclear power reactors under construction outside the United States. Excluding Russia, China, South Korea, and Ukraine, there were a total of 28 new reactors under construction in 15 countries. Almost half of this market (13 reactors in 7 countries) is controlled by Russia, with Russian reactor technologies being deployed by Russian entities. An assessment by the U.S. Nuclear Energy Institute noted that Russian involvement in new nuclear developments in other countries creates a potential century-long relationship when considering the full project life cycle of licensing, construction, operations, and decommissioning. Because Russian nuclear vendors are state-owned enterprises, this is tantamount to Russian government control over foreign nuclear power infrastructure. In short, there is potential for “weaponization” of civilian nuclear cooperation by Russia, in particular the provision of nuclear fuel, if the host country acts in a manner that is counter to Russian global interests.

The international community’s reliance on Russian nuclear technology leaves it vulnerable to Russian economic and political shocks that could impact reactor construction, fuel supply, or even maintenance. Proposals to sanction Rosatom, the Russian-owned nuclear enterprise, could cause serious disruption to the U.S. electricity supply. Some escalatory scenarios could even lead to Russia cutting off its LEU and/or fuel supply to other countries.

Bolstering the U.S. Nuclear Energy Industry

While Russia continues to play a significant role in the global supply of uranium, enrichment services, and new reactor builds, there are opportunities for the United States and its allies to chip away at its dominant position, and in doing so, strengthen nonproliferation and enhance global energy security in a manner that also provides domestic economic benefits in the form of new jobs, cost reductions in future nuclear energy projects (with reduced electricity costs to consumers), and expanded U.S. economic growth.

For example, Finland has cancelled plans to build a new Russian nuclear power reactor, citing security concerns stemming from the invasion of Ukraine. Poland, once a close partner with Moscow on nuclear research, just last month selected American and South Korean firms to develop its first two nuclear power plants. Westinghouse is now providing some nuclear fuel to power reactors in Ukraine that were once completely reliant on Russian supply and will soon be doing the same for similar reactors in the Czech Republic and Bulgaria.

The United States has the capabilities and tools to effectively counter Russian dominance of the growing international commercial nuclear market, but it lacks the whole-of-government strategy needed to effectively compete with the Russian state-sponsored enterprises (and similarly with the Chinese). The U.S. policy response needs to be tailored to the differing circumstances of each element of the nuclear fuel cycle.

Figure 1: The nuclear fuel cycle. Source: World Nuclear Association, 2021.

Uranium Mining and Milling: Russia is the 6th largest miner of uranium from its domestic resources, but this significantly understates Russia’s role in the global uranium market. Russia also owns uranium mining activities in Australia and Canada and has a small holding in the United States, among other countries. Russia also supplies 14% of the uranium the United States uses as fuel. While the extension of Russia’s ownership of uranium mining interests in foreign countries merits close scrutiny, the current global uranium market is robust, and the major suppliers have good relationships with the United States.

Uranium Enrichment: As opportunities continue to emerge for the United States and its allies to play a greater role in the development and servicing of current-generation reactors, there is also an opening to establish leadership on the next generation of small modular and advanced reactors. These designs are gaining increased consideration domestically and internationally for their safety features and potential cost savings. The United States is already at the cutting-edge of technology development for these new reactors but restoring U.S. leadership requires matching technological prowess with the commensurate manufacturing capabilities necessary to build a nuclear energy infrastructure that is safe, secure, reliable, and cost effective.

Specifically, many future reactors will use a high assay low enriched uranium (HALEU) fuel, a market that is currently almost entirely controlled by Russia. HALEU is uranium enriched above the 4-5% level used in the current generation of nuclear power reactors, but below the 20% threshold for HEU. The challenges in producing HALEU fuel largely stem from the United States’ absence of domestic uranium enrichment capabilities. Building this capability will be key for both domestic energy security, as well as the ability to sell U.S. next generation reactor technology and services abroad.

The Biden Administration and Congress took a first step in developing a domestic HALEU supply chain by providing $700 million for this purpose in the Inflation Reduction Act. This is a good start to help build supply for the first several HALEU fueled reactors that are slated to come online later this decade, but much more will be needed to ensure a stable, long-term solution.

In the shorter term, the Department of Energy (DOE) Advanced Reactor Development Program (ARDP) is currently cost-sharing demonstration projects for two new advanced reactor concepts that would use HALEU fuel, the high temperature gas cooled reactor provided by X-Energy and the molten salt reactor concept developed by TerraPower. Here federal funding can help jumpstart the HALEU production process by supporting commercial demonstration enrichment projects and the downblend of HEU from DOE inventories. But this only produces a limited supply potential that can serve as a stopgap, and alone is not a sustainable solution.

In the longer term, the familiar economic dilemma is that companies considering making the substantial investments required for new enrichment facilities need some assurance of sustained HALEU demand, while the new reactors required to generate this demand can only be developed with the assurance of a sustained HALEU supply.

Any expansion of domestic enrichment capacity is intertwined with national security requirements. The Tennessee Valley Authority currently operates commercial power plants, including one (Watts Bar in Tennessee) that also produces the only domestic supply of tritium for the Department of Energy. Tritium is essential for sustaining the U.S. nuclear weapons stockpile. Another national security need for enriched uranium will be for the eventual production of fuel for nuclear Navy propulsion. Under the provisions of the 1970 Treaty of Almelo, the UK, Netherlands, and Germany formed a consortium, URENCO, for the purposes of enriching uranium for commercial nuclear power—but prohibited from enriching uranium that could be used for nuclear weapons programs. This agreement was expanded in 1992 to include the United States to facilitate U.S. deployment of URENCO enrichment technology. Similar agreements are in place regarding Orano centrifuge technology and laser enrichment technology. Thus, the enriched uranium fuel for the Watts Bar and Sequoyah plants used to produce tritium for nuclear weapons (and eventually naval nuclear reactor fuel) cannot be supplied by URENCO. The current enriched uranium supply to the TVA reactor is being provided from the downblending of weapons-grade highly enriched uranium (HEU) held in inventory by DOE that is designated as “unobligated,” that is, enriched uranium that is not subject to a foreign government requirement that it can be used only for peaceful purposes. The U.S. holds strongly to this requirement as it is a key element of U.S. and international nuclear non-proliferation policy. The DOE practice of downblending HEU for use in reactors producing tritium provides a temporary solution, but over time the diminishing stockpile could compromise the U.S. national security posture; furthermore, if often takes longer than anticipated to build a new nuclear facility. A new domestic enrichment supply source will be needed, one that uses a complete U.S. supply chain, including U.S.-origin enrichment technology (presumably centrifuge). We strongly urge that the Administration and Congress come together to make a plan and schedule to meet this national security need expeditiously.

Commercial Nuclear Power Generation: In 2012, the Obama Administration initiated efforts to develop a whole-of-government effort dubbed “Team USA,” led by a senior White House official with assigned responsibilities to coordinate government efforts. After an early success in the award of an ExIm Bank credit for export of U.S. origin nuclear technology to support the U.A.E. nuclear project, the effort stalled when Congress failed to reauthorize the ExIm Bank on a timely basis and the Administration and Congress failed to come together on appointments to the Board needed to establish a quorum. The Team USA initiative was allowed to languish during the Trump Administration. The current leadership of the ExIm Bank has sought to take a more proactive approach to financing export of U.S. origin nuclear reactor technologies, working with companies to land projects in several Eastern European countries. The effort, however, still does not attain the whole-of-government strategy originally envisioned for Team USA. This should be rectified with a renewed Administration commitment.

Spent Nuclear Fuel Management: Nuclear fuel disposition is another area in the nuclear fuel cycle where Russia currently has an edge but is also another opportunity for the U.S. to wrest global leadership. Currently, as part of its commercial nuclear power generation offering to the global market, Russia includes a used fuel take back proposal. The United States is at a significant disadvantage currently relative to Russia, but there are opportunities for the United States to assume a leadership role in this space. Simply stated, the United States has no current program for used fuel disposition for its own domestic commercial spent fuel, let alone spent fuel that would be produced from the export of U.S. reactor technologies.

In 2012, the report of the Blue-Ribbon Commission on America’s Nuclear Future, of which I was a member, recommended an eight-point strategy for used fuel disposition that included consent-based approaches to siting future nuclear waste management facilities under a new federal organization and revised financial management structure. One of the eight elements was “active U.S. leadership in international efforts to address safety, waste management, non-proliferation, and security concerns.” Implementation of that strategy was abandoned by the Trump Administration in its attempt to revitalize the defunct Yucca Mountain repository program. A core part of the strategy advocated by the Blue-Ribbon Commission is establishment of one or more facilities to consolidate used fuel storage for 50 to 100 years, with the Federal government taking title to the irradiated fuel when it is transported to consolidated storage (as is currently required). It is past time to implement this strategy, while simultaneously revitalizing efforts to research and pilot long term geological isolation.

Adoption of a comprehensive strategy, modeled after the Blue-Ribbon Commission recommendations, would put the United States in a stronger posture to work with other countries to export U.S. commercial nuclear offerings. A domestic nuclear waste strategy also could provide the foundation for developing a nuclear fuel leasing program with return of spent fuel. Such a program was originally outlined as an Assured Nuclear Fuel Services Initiative in a white paper I co-authored in 2004. As noted in the paper, “…the principle of spent fuel return is already well established; for example, the United States accepts return of highly enriched research reactor fuel of U.S. origin. This type of effort, combined with the financing policies outlined earlier in this statement, would provide a winning strategy to deprive Russia from gaining a further foothold in the expanding global nuclear energy market, one of increasing importance to a clean energy transition.”

Constraining Nuclear Proliferation

By investing in and developing a robust nuclear energy supply chain, the United States will not only reap economic and energy security benefits but can also regain important leverage in the international nonproliferation regime. The capability to produce weapons-usable materials, namely HEU and plutonium, remains the most difficult part of nuclear weapons program development. Yet the inherent dual-use nature of the nuclear fuel cycle means that some of the same technologies that can be used for nuclear power can also be used to produce the materials needed for a nuclear weapon. Mitigating proliferation concerns is a central component of every nuclear export from the United States, while the same cannot be said of Russia.

There are several ways that the United States can use its influence to constrain proliferation activity. The first is by insisting on civil nuclear cooperation agreements with legal prohibitions on enrichment, which can be used to produce HEU, and reprocessing, which can be used to produce weapons-usable forms of plutonium – the so-called “Gold Standard.” This approach has been successful with the United Arab Emirates and Taiwan, but has yet to be adopted by others. Renewed U.S. leadership in the global nuclear supply chain could increase leverage for getting more partners on board with this approach, but it would also be prudent to explore other methods for preventing the spread of weapons-usable materials.

The United States should remain creative and flexible in its approach to U.S. civil nuclear cooperation while retaining nonproliferation as a top priority. While the United States should seek nuclear agreements with the Gold Standard wherever possible, this may not be feasible in all cases. As an alternative, the United States could seek agreements with more expansive frameworks of intrusive monitoring and verification—including not only the Additional Protocol with a fixed time period of IAEA access to suspect sites but also additional measures to guard against undeclared activities, such as monitoring the entire uranium supply chain and confirming the absence of any weaponization activities. Rather than prohibit it, such an agreement could place strict limits on enrichment, including the level of enrichment and the amount of material a country could keep in its stockpile. This approach could help ensure that a country does not use enrichment technology to produce HEU.

Reprocessing presents a more complex challenge because its use as part of a civilian program inherently produces weapons-usable plutonium materials. Fortunately, unlike enrichment, which is essentially a required component of a modern-day fuel cycle, reprocessing is neither necessary nor particularly desirable from an energy or economic standpoint. It would therefore be wise to vigorously discourage reprocessing in all cases. The United States could set a powerful example by itself forswearing commercial reprocessing, at least for a very long time. This would in no way impede the security, economic, or climate change goals that underpin its nuclear energy strategy.

Russia’s unjustified, miscalculated and horrendous war of choice in Ukraine is an historical inflection point for global commerce, climate, security and governance. Re-establishing order and a new equilibrium in each of these sectors is necessary for a future global order that will enhance security and economic prosperity for all members of the international community.

####

Sign up for our newsletter to get the latest on nuclear and biological threats.

A collection of missile tests including the date, time, missile name, launch agency, facility name, and test outcome.

At this critical juncture for action on climate change and energy security, 20 NGOs from around the globe jointly call for the efficient and responsible expansion of nuclear energy and advance six key principles for doing so.

Information and analysis of nuclear weapons disarmament proposals and progress in Belarus